Where can I place this article? Let’s place it in “Explore the World” category. You can find it under People menu option.

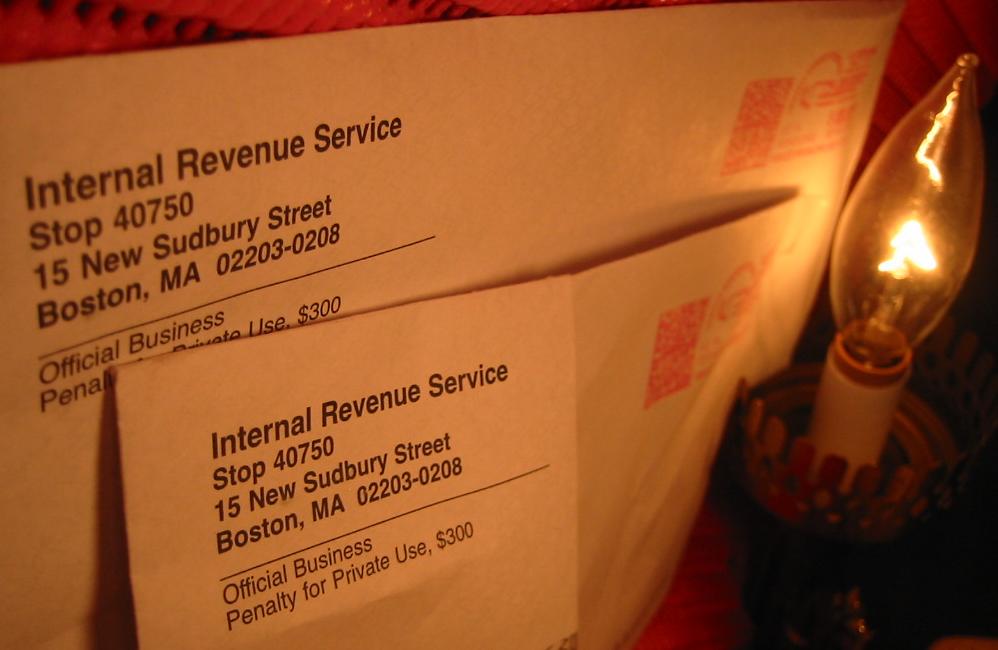

Sometime in August you could receive a letter from IRS, prompting you to call them and setup an appointment. On this letter you will find, what area of Tax return (ex.: Sch D – Short Term Gain/Loss) and what year (ex.: 2008) that triggered an alarm on their system. Nowhere on that letter will they use word AUDIT. Instead, you will see that “Your tax return has been selected for examination“.

You might need to read this letter several times. There is usually form 4564 attached – Information Document Request. This form goes into a little more details, what to bring with you for the appointment. Expect it to be too general and too inclusive. Receipts, vouchers, statements. But you have to use your own judgment, what documents would you need to prove your numbers.

If you file your return jointly, both of you will receive identical letters. But only one of you has to call, and only one of you has to show up for the interview.

You need to call within 10 days of receiving the letter. To your surprise, you actually are getting a real person on the other end of the line, when you call. Due to security reasons, IRS never contacts you over email. If you call on Monday at 8:30 am, they could call you back on Wednesday and setup a time slot convenient for you. Your vacations and personal circumstances are taken into consideration.

After you setup an appointment, you will get a second letter with confirmation. There are no new information and no more details on what to bring or what to prepare for.

Appointment takes 2 to 3 hours and that is why you have one slot in the morning (9am) and one slot in the afternoon (1pm). If you arrive early, you might get summoned early and save some time on your garage parking ($23 in Boston for 1h and 11m).

Your task is to show that your numbers are correct. So get prepared. If the area of audit is Short term gains and losses on Schedule D, bring your spreadsheets, showing how every purchased lot matches up with every sold lot. Print from 1099-B from your broker.

Alarms on any computer system (including IRS) are just percentages. If your deductible expenses are very high, or if your losses are higher, than your annual income, that could trigger an alarm. There is nothing suspicious about these circumstances, just unusual. Do not go into a mad rant about what could cause the invitation. Nobody is to get you. It is all about numbers.

You will meet with an accountant who is a bright and quick-witted individual. So have the picture clear in your head, before presenting your case to the person. If you understand the numbers that your accounting software inserted for you, you would be able to explain calculations and numbers. If you do not understand, how certain numbers were calculated, it will take longer for two of you to figure that out.

In a couple of days after the interview you will receive a third letter from IRS. On that letter you a looking for “pleased to inform you I’m proposing no change to your tax return.” This means you are in luck. You are not at fault. All your records are in order, and you do not have to do anything to redo your return.

After you done with IRS Audit, you can’t be summoned for the next two years. For example, if you were invited for IRS Audit for tax year 2008, IRS can’t call you back for audit for years 2009 and 2010. This is very similar to Jury Duty. Good luck!

So I quit my job and went to the New England Culinary Institute for the full two years and worked in the restaurant industry after that until finally I thought I had a grasp on what I needed to do what I do.

I still get nervous on dates. I’ll be sitting at dinner with a guy and I have to excuse myself and go to the bathroom because I can’t breathe.