It is painful to state that so many important investment decisions are based on a P/E ratio, but it is very hard to find a clear explanation on how to calculate this very P/E for a given company.

This article is written to demonstrate, how to calculate Earnings Per Share (EPS) and P/E using Newmont Mining (NEM) as an example.

We have to start with obvious banality: Price-to-Earnings ration (P/E) is a Stock Price ($50) divided by the total of last 12 month earnings.

What type of earnings we need to get? We need “Net Income Applicable To Common Shares”.

Where can we get this information? Some free sites provide last 4 quarters of earnings in a convenient table format.

Why do we need quarterly date? We need quarterly data to decide, if it is a representative of company performance. Quarterly Net Income would allow us to judge, what total number to use. Yes!

To steer away from platitudes, let’s dive right into an example. An article in Barron’s (№21, May 21, 2012) states that NEM is a attractive equity with P/E around 11. However, if you look many online investment quotes, you will see a P/E of 44 for that company. What is going on?

First, let’s look into quarterly Net Income for last 4 quarters. Barron’s online site provide not 4, but cool 5 most recent quarters: http://quotes.barrons.com/NEM/financials/quarter/income-statement. Barron’s site might require a subscription to access, but you can use a free Yahoo! site as well: http://finance.yahoo.com/q/is?s=NEM.

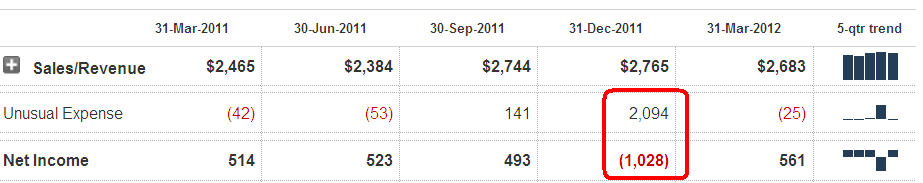

Numbers will show (please note that many intermediate row are omitted in a table bellow):

First what we see is a large spike in unusual expenses in the last quarter of 2011. But company continuously produces a steady revenue quarter after quarter.

Now, if we follow the formula and sum up last four quarters of NEM Net Income, we will receive a figure of only $549 mil. If we now divide this calculated Yearly Income per number of shares (490.6 mil) we will get a EPS of $1.12. It means each share is supported by over a dollar of NET yearly earnings. These low earnings will bring us to a very high P/E of 44.7 (share price $50 / EPS $1.12). This is not very attractive at all. Too expensive. Where is the problem?

But let’s look into income more realistically. Do we need to take into consideration an unusual $2 bln. expense that did not interfere with normal company operations? This could be some acquisition cost, or litigation, or tax, of fine. Here our readers can help to improve the content: What was that unusual expense in the last quarter of 2011?

In any event, if we take last 4 “regular” quarters with normal Net Income, we will arrive to a much more formidable yearly income of $2,091 mln. and much higher EPS ($4.26), and much lower P/E (11.7). Wait a second. This is a real catch! This a stable gold mining stock with low “invisible” P/E, with gold prices on the normal inflationary rise and… And it pays a 2.8% dividend.

When I put all this in one convenient row in Excel, I realized that this an excellent way to take a preliminary look into a company actual worth. Why didn’t I use this simple method before?

Be the first to comment